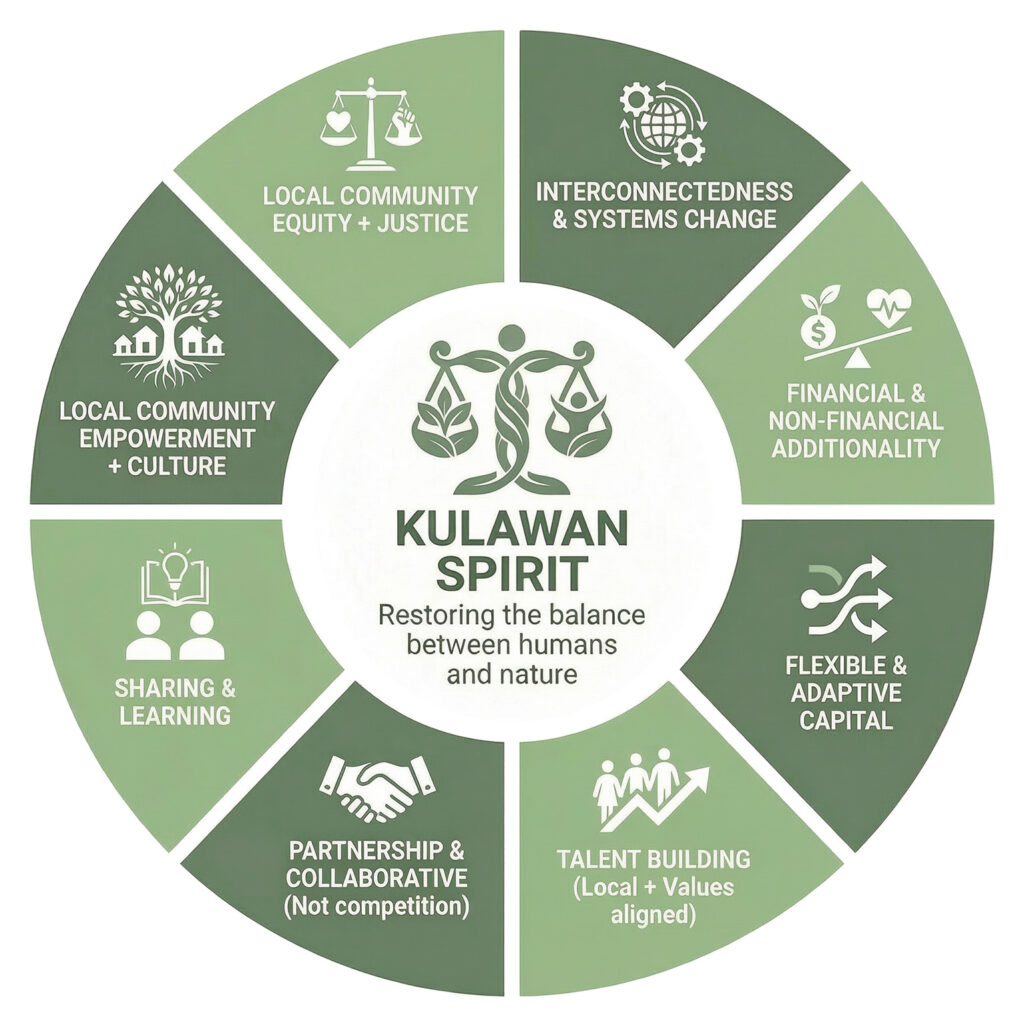

Our journey to deploy catalytic capital for nature positive organisations in Asia which are striving to restore balance between humans and nature to benefit all life on our planet

Kulawan is a nature catalytic capital programme. We provide flexible, patient, and risk tolerant funding that best suit the needs of nature-positive ventures, fund managers or projects, ultimately seeking to address their most challenging capital needs and help “bridge” them to the next stage of funding.

With equity and debt capital, we are willing to take on higher levels of risk while accepting moderate financial returns. Our intention is to help organisations have the right capital to prove their commercial and impact models and over time, enable them to hopefully attract more investments and like-minded partners to support their growth and scale their impact.

Through building a portfolio of catalytic capital investments, Kulawan aspires to benefit the wider field and enable learnings for us to share with others interested in deploying this type of capital.

Kulawan aims to support the global movement seeking to build a new economic system centred on a just and regenerative world that operates within healthy planetary boundaries .

We believe in order to achieve this, and address the significant financing gap for nature and biodiversity, philanthropic and market rate impact investment capital are not enough. Hence we focus on helping to support emerging business models which harness nature and have a strong focus on benefitting local communities.

Furthermore, from listening to actors in the sector and our experience so far, we believe there are gaps in the sector which we are aiming to help address. These include:

Lack of patient and flexible capital (i.e. restrictive grants or conventional investment capital seeking market rate returns)

Lack of funding for first-time fund managers and/or new strategies of existing managers

Lack of readily available follow-on capital

Lack of capacity building support (e.g. venture building services)

Lack of nature-based venture and fund managers in Asia with enough scale to attract larger and more commercial investors.

We support organisations in Asia which are addressing the following priority areas determined by science:

Kulawan seeks to support the ‘doers’, the individuals who are working on-the-ground with nature, or directly with the ventures that are trying to develop new business models which work with local communities and do not extract from our planet.

We have a particular focus on Asia based or focused:

Ventures:

Fund Managers:

We support Asia-based or focused organisations which are values and mission aligned to RS Group.

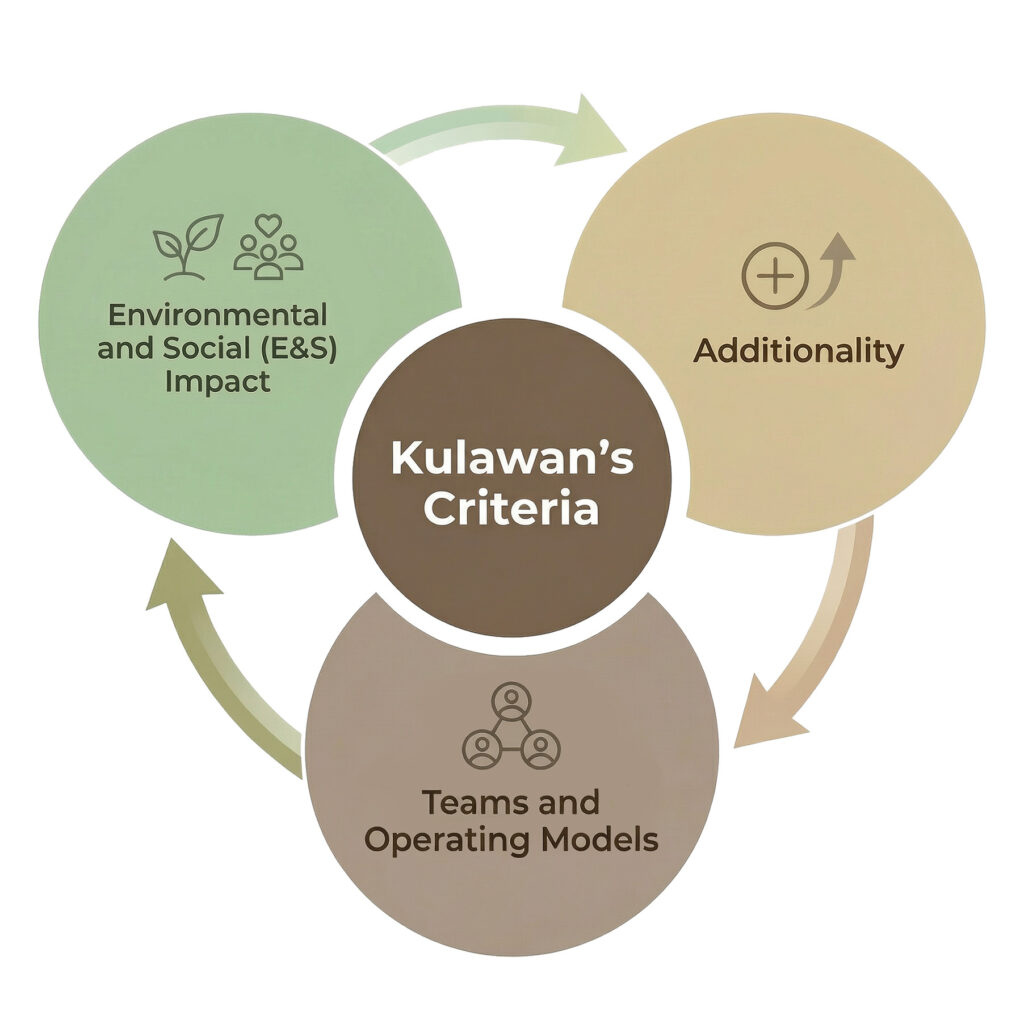

The main outcomes we are focusing on are:

Environmental and Social (E&S) Impact – contributing to reducing or preventing CO2e emissions, increasing social and livelihood benefits of local communities, enhancing and protecting more of our planet’s biodiversity.

Teams and Operating Models – increasing more local talented individuals and teams in Asia to develop and scale non-extractive new types of operating/business models.

Additionality – we investing in areas where most others are not able to, meeting real funding gap needs, and leveraging our network to benefit our partners beyond just financial support.

The term “kulaw-wan” comes from a third indigenous language used by the Manobo Indigenous Peoples of Mindanao, Philippines. It refers to “environment” or “nature” and reflects their belief that land is life itself – alive and a source of all life.

[Source: Droz, L., Chen, HM., Chu, HT. etal. Exploring the diversity of conceptualizations of nature in East and South-East Asia. Humanit Soc Sci Commun 9, 186 (2022)